Overlooking the Truth About the Massive Growth in Unionized Government Payrolls

From 1998 to 2008, inflation-adjusted state and local government payrolls grew roughly 50% faster than private-sector payrolls. And state and local government compensation shrank far less than private-sector compensation from 2008 to 2010.

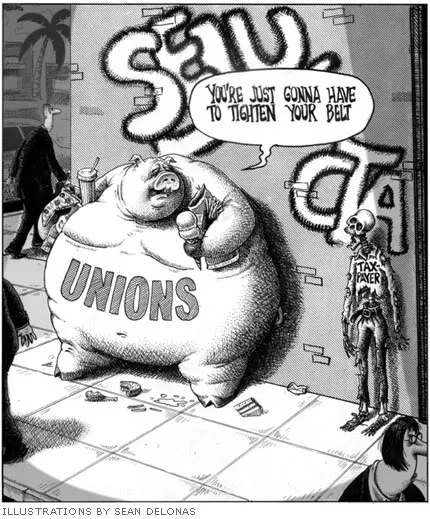

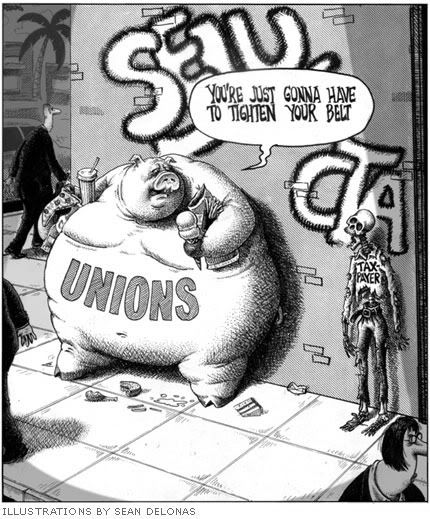

Just two years ago, the U.S. Labor Department reported that, for the first time ever, a majority of unionized workers across America are now government employees. As recently as 1980, less than a third of all employees subject to “exclusive†union bargaining worked for the government. Today more than 42% of state and local government employees are under a union contract. Unionization in the state and local government sector is 5.5 times as great as in the private sector. That’s bad news for private employees, including union members whom union officials claim to represent, and for everyone else who pays taxes.

For many years now, Big Labor featherbedding and counterproductive work rules have sharply increased real taxpayer costs for compensation of state and local government employees. In fact, according to inflation-adjusted U.S. Commerce Department data, taxpayers’ aggregate real costs for compensation of state and local government employees soared by 29.5% between 1998 and 2008 – an increase roughly 50% greater than the total real growth for private-sector employee compensation.

From 2008 to 2010, the country experienced a severe national recession. Businesses whose revenues were plummeting had no choice but to cut back real compensation for private-sector employees by 5.2% over this two-year period. But largely because of the extraordinary legal privileges of government union bosses, state and local compensation fell by only a quarter as much as private-sector compensation, in percentage terms, from 2008 to 2010.

It is simply not sustainable for public payrolls to grow far faster than private payrolls during good economic times and then to shrink far less than private payrolls during bad economic times. Especially since the long-term growth in the demand for the major public employee-provided services is relatively slow. From 1998 to 2008, for example, the number of primary-and-secondary-school-aged children (ages five to 17) nationwide increased by 4.0%, less than a third of the overall population increase.

Thanks largely to the efforts of fed-up taxpayers, it appears that since the beginning of 2011 the relentless growth in the share of all U.S. income that is consumed by state and local government compensation has halted. Indeed, for the first time in many years unionized government payrolls are now, it appears, momentarily declining relative to private payrolls. But this seeming trend would have to go on for a long, long time to get the balance between America’s private and government sectors back to what it was as recently as the late 1990’s. Experience indicates that’s very unlikely.

Most recent news accounts regarding “mounting public job losses,†such as the Washington Post story linked above, fail abysmally to give a realistic picture of the U.S. economy. They fail to put the relatively small cuts in state and local government payrolls over the past couple of years into context by downplaying the rapid-fire growth in these payrolls for decades before, including even the recession years of 2008 and 2009. Deliberately or inadvertently, the Washington Post and many other national media are doing propaganda work for government union kingpins.