Union Bosses Push For Higher Taxes on Everyone Who Works For a Living

Annual State-Local Tax Burden Ranking (2010) – New York Citizens ..

The Democratic Party’s Secret Attack On The Middle Class

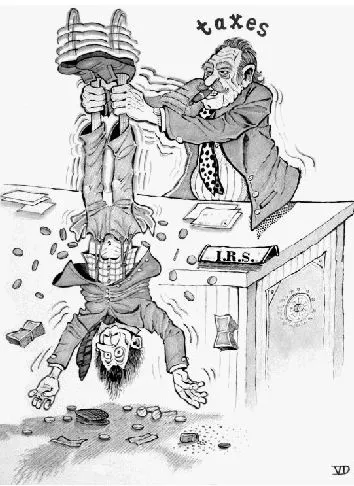

A new analysis shows Big Labor-backed politicians favor higher taxes on ordinary income earners as well as on high income earners (Cartoon: Econintersect).

A background paper published this week by the nonpartisan, Washington, D.C.-based Tax Foundation shows there continues to be a strong, positive correlation between legally sanctioned compulsory union dues and heavier state and local tax burdens.

As authors Elizabeth Malm and Gerald Prante recall in the introduction to their paper (“Annual State-Local Tax Burden Ranking, 2010”), the Tax Foundation has for nearly two decades “published an estimate of the combined state and local tax burdens shouldered by the residents” of each of the 50 states. To calculate the overall state-local tax burden for the residents of a state, the Tax Foundation adds up all the state and local taxes they pay “both to their own and other governments” and then divides these totals “by each state’s income.” (See the first link above for more information.)

Following a well-established pattern, taxpayers who resided in states lacking Right to Work protections for employees carried the heaviest tax burdens in 2010. Not one of the 14 states (New York, New Jersey, Connecticut, California, Wisconsin, Rhode Island, Minnesota, Massachusetts, Maine, Pennsylvania, Illinois, Maryland, Vermont and Hawaii) whose residents had to fork over more than 10.0% of their income in state and local taxes has a Right to Work law on the books.

Meanwhile, of the 11 states with the lightest 2010 state-local tax burdens, ranging form 7.0% to 8.4% of income, nine (South Dakota, Tennessee, Louisiana, Wyoming, Texas, Alabama, Nevada, South Carolina and Arizona) are Right to Work states. The sole exceptions are forced-unionism Alaska and New Hampshire. And in both these states, extraordinarily high living costs all but obliterate any advantages residents derive from lower taxes.

The roots of Big Labor’s intense support in recent decades for more government spending and higher taxes are both ideological and practical. Many union officials are suspicious of free enterprise. Indeed, former AFL-CIO President John Sweeney (1995-2009) is a card-carrying member of the Democratic Socialists of America. Union officials also know that state and local government employees are roughly 5.5 times as likely to be unionized as private-sector employees. Growth of the government sector, relative to the private sector, very often means more forced-dues money and power for Big Labor.

In states where employees are liable to be fired for refusing to pay dues or fees to an unwanted union, the union hierarchy has more clout to get what it wants. And it uses that clout to push for higher taxes. This is a key reason why state-local tax burdens are on average far more onerous in forced-unionism states.

Some apologists for the union brass and heavy taxation insist that New Jerseyites should be glad to hand over an average of 12.4% of their income in state-local taxes, and Californians are stingy if they don’t want to give up even more than 11.2%, as they did in 2010. Higher taxes buy better public services that are obviously worth the extra money, insist Big Government cheerleaders.

But the evidence for this claim is weak to nonexistent. Take K-12 education, which consumes a far higher share of state-local tax expenditures than any other government activity or any entitlement. As Stanford University education-policy specialist Terry Moe explained in his 2011 book Special Interest, studies that account for variations in student backgrounds and characteristics of schools and districts unrelated to collective bargaining find again and again that monopolistic unionism undermines the effectiveness of schools. The more sweeping the scope of teacher union officials’ “exclusive” bargaining privileges is, the more detrimental the impact. Taxpayers fork over more money for K-12 education, and get less in return, as a consequence of compulsory unionism.

Another dubious contention of the Big Government coalition is that it isn’t ordinary income earners in states the Tax Foundation cites as the most heavily taxed who get hard. It is only the high earners, supposedly, who get soaked, and don’t they deserve it?

Even if this were true, the record shows that “soak the rich” tax regimes end up hurting people at all income levels. To take just one example, because the incomes of the highest earners are typically far more volatile than those of average earners, states that rely too heavily on the highest earners for taxes suffer from dramatic boom-bust revenue cycles. But the fact is that Big Labor-controlled states extract more taxes from ordinary earners, too, as a recent Forbes commentary by businessman and public-policy writer Charles Kadlec shows. (See the second link above.)

An analysis of state median family incomes for the years 2009-2011 and personal income tax rates, overseen by Mr. Kadlec, concluded the marginal state income tax rate for a median-income family in the 18 forced-unionism states (plus Washington, D.C.) that voted for the Democratic presidential nominees in 2000, 2004 and 2008 is 5.4%. That’s 24% higher than the 4.3% marginal tax rate for a median income family in the 22 states (18 of them Right to Work) that voted for the Republican nominee in the last three presidential election cycles. And the average minimum sales tax in the 18 Democratic states plus D.C. was 5.4%, compared to 5.0% in the 22 Republican states.

The record indicates that union bosses and the politicians they bankroll favor higher taxes on everyone who works for a living, regardless of any rhetoric suggesting the contrary. This is true at all levels of government, but it is especially easy to see at the state level, where the 23 states with Right to Work laws now on the books represent an appealing alternative to Big Labor strongholds like California, Illinois, New York, and New Jersey.