Taxpayers Move With Their Bank Accounts to Right to Work States

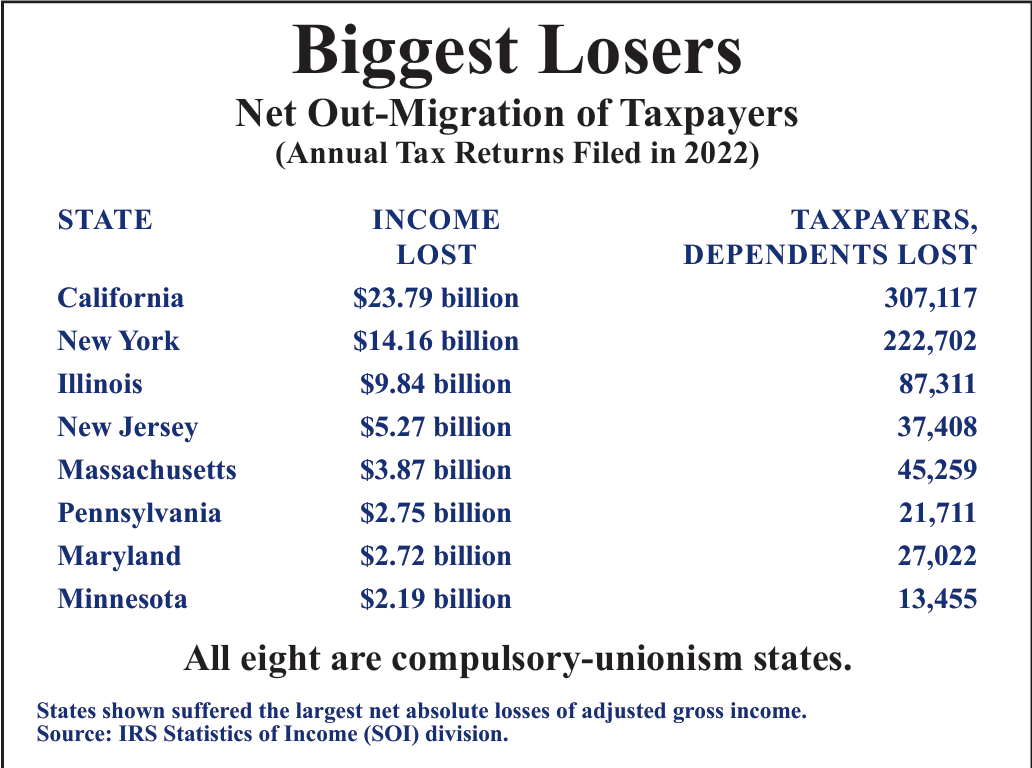

For decades, states like New York, California and Illinois have evidently been paying a high price for allowing dues-hungry union bosses to continue getting workers fired for refusal to bankroll their organizations. Year after year, far more taxpayers have been leaving forced dues states than moving into them. The cumulative loss has been cutting into their revenue bases.

Recently released data from the Internal Revenue Service (IRS) indicate the cost of forced unionism soared by roughly 75% on annual returns filed in 2021 and 2022 combined, compared to 2019 and 2020 combined.

National Right to Work Committee President Mark Mix commented: “It shouldn’t require fiscal catastrophes to persuade state politicians to stop hurting the vast majority of their constituents just so union bosses’ special privileges can be perpetuated.

“But state insolvency may well arrive before Big Labor politicians in states like New York, California and Illinois acknowledge the truth about the devastating effects of forced unionism.”

The facts speak for themselves. As a group, the 23 states that lacked Right to Work laws in 2021 and 2022 lost a net total of $139.0 billion in adjusted gross income (AGI). That’s a 75% greater loss than what these same states endured in 2019-20.

All contents from this article were originally published in the National Right to Work Committee Newsletter.

If you have questions about whether union officials are violating your rights, contact the Foundation for free help. To help us educate workers and citizens about their labor rights and continue to share valuable news and research, please support The National Institute for Labor Relations Research by donating now.